The Effect of Ownership Concentration on the Performance of Nigerian Banking Industries, An Empirical Investigation

Abstract

This study investigated the effect of ownership concentration on the performance of the Nigerian banking sector for the period of 2008 to 2014.The study employed a sample of 5 major commercial banks in Nigeria selected on the bases of size. The data for the study was generated from the annual report of each of the banks under study for the period covered. We employed pooled panel data regression analysis to empirically evaluate the data. Both accounting and market based performance were employed with ROA and ROE as the key variable to proxy accounting based performance while EVA were used for market based performance. The result of the pooled panel data analysis reveals that ownership concentration has positive but insignificant effect on both the accounting and market based performance measures employed in the model. On the same vain, firm size which was used as a control variable has a positive and significant effect on both accounting and market based measure of banks performance. We therefor recommend that as concentrated owners seek to increase their interest, appropriate legal and control measures should be put in place to ensure that major owners don’t control the banks to their own advantage and to the expense of minority shareholders and the public at large.

Downloads

References

Abbas, A., Naqvi, H. A., & Mirza, H. H. (2013). Impact of large ownership on firm performance: A case of non financial listed companies of Pakistan. World Applied Sciences Journal, 21(8), 1141–1152. http://doi.org/10.5829/idosi.wasj.2013.21.8.1916

Andersson, J. (2004). The link between ownership structure and firm performance. Industrial and Financial Economics.

Andrei Kuznetsov, Rostislav Kapelyushnikov, N. D. (2013). the Impact of Concentrated Ownership on Firm Performance in an Emerging Market: Evidence From Russia. Procedia -Social and Behavioral Sciences, 12(1), 1–40.

Balsmeier, B., & Czarnitzki, D. (2010). Ownership concentration, institutional development and firm performance in Central and Eastern Europe. ZEW Discussion Paper, 10-096(10). Retrieved from https://lirias.kuleuven.be/bitstream/123456789/344786/1/2012-04-11 - ZEWdp10.096.pdf

Bash, E. (2015). Ownership structure and firm performance in non-listed firm: Evidence from Spain. Pakistan Journal of Social Sciences (PJSS), 1(June 2009), 1–32. http://doi.org/10.1017/CBO9781107415324.004

Brown, L. D., Levine, M., & Wang, L. (2013). A semiparametric multivariate partially linear model : a difference approach. STATISTICA SINICA, 1–23.

CHEN, L. (2012). The Effect of Ownership Structure on Firm Performance Evidence from Non-financial Listed Companies in Scandinavia. Finance & International Business, 4(11), 112–129.

Claessens, S., & Djankov, S. (1999). Ownership Concentration and Corporate Performance in the Czech Republic. Journal of Comparative Economics. http://doi.org/10.1006/jcec.1999.1598

Grosfeld, I. (2006). Ownership concentration and firm performance : Evidence from an emerging market Ownership Concentration and Firm Performance : Evidence from an Emerging Market. SSRN Electronic Journal, 2(834), 27.

Isik, O., & Soykan, M. E. (2013). Large Shareholders and Firm Performance: Evidence from Turkey. European Scientific Journal, 9(25), 23–37.

Issham, I. (2013). The effect of ownership concentration on company performance. African Journal of Business Management, 7(18), 1771–1777. http://doi.org/10.5897/AJBM11.1861

Javid, A. Y., & Iqbal, R. (2008). Ownership Concentration , Corporate Governance and Firm Performance : Evidence from Pakistan. The Pakistan Development Review, 47, 643–659.

Lskavyan, V., & Spatareanu, M. (2006). Ownership concentration, market monitoring and performance: Evidence from the UK, the Czech Republic and Poland. Journal of Applied Economics, 9(1), 91–104.

Maher, M. E., Maher, M. E., Andersson, T., & Andersson, T. (2000). Corporate Governance: Effects on Firm Performance and Economic Growth. SSRN Electronic Journal, (February). http://doi.org/10.2139/ssrn.218490

Manawaduge, a, & Zoysa, a De. (2013). the Structure of Corporate Ownership and Firm Performance: Sri Lankan Evidence. Corporate Ownership & …, 11(1), 723–734. Retrieved from http://www.virtusinterpress.org/IMG/pdf/COC__Volume_11_Issue_1_Fall_2013_Continued8_.pdf#page=23

Nor, F. M., Shariff, F. M., & Ibrahim, I. (2010). The effects of concentrated ownership on the performance of the Firm: Do external shareholdings and board structure matter? Jurnal Pengurusan, 30, 93–102.

Pathirawasam, C. (2008). Internal Factors Which Determine Financial Performance of Firms : With Special Reference To. Economics Letters, 22(11-1), 62–72.

Pathirawasam, C., & Wickremasinghe, G. (2012). Ownership Concentration and Financial Performance: The Case of Sri Lankan Listed Companies. Corporate Ownership and Control, 9(4), 170–177.

Scholten, M. (2014). Ownership structure and firm performance : Evidence from the Netherlands. Research in Economics, 7(10), 1–10.

Su, L., & Ullah, a. (2010). Nonparametric and Semiparametric Panel Econometric Models: Estimation and Testing. Handbook of Empirical Economics and Finance, 455–497. http://doi.org/10.1201/b10440

Wang, L., Brown, L. D., & Cai, T. T. (2011). A difference based approach to the semiparametric partial linear model. Electronic Journal of Statistics, 5, 619–641. http://doi.org/10.1214/11-EJS621

Zakaria, Z., Purhanudin, N., & Palanimally, Y. R. (2014). Ownership Structure and Firm Performance : Evidence From Malaysian Trading and Services Sector . European Journal of Business and Social Sciences, 3(2), 32–43. Retrieved from URL: http://www.ejbss.com/recent.aspx

TRANSFER OF COPYRIGHT

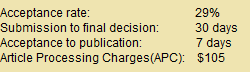

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.