Financial Policy and Taxation Relevancy in Theoretical and Practical Financial Economics

Abstract

The foremost purpose of this paper is to concisely explain to individuals teaching economics in an academic setting or using economics in a practical setting some of the basics of long run financial theory and taxation items focusing on the dividend policy decision of a corporation. The main motivation for this study is based on observations of economists being very deficient in the discipline of finance and taxation especially in long run financial concepts. Many times practitioners or academics who are educated in the area of economics lack any type of background in finance and/or taxes and therefore are deficient with their knowledge of financial theory and applications. This disconnect prevents using many financial applications in their own classes, in their own businesses or with their own research. This paper serves as a primer to some of the long run dividend policy theories that individuals can use as a starting point to their additional research, study or use in teaching. Areas related to dividend policy and financial theory in general can be utilized by economists in academia and the private sector to enhance and advance their professional careers.

Downloads

References

[2] Baker, M. and Wurgler, J. (2004). A Catering Theory of Dividends. Journal of Finance. 59 (Jun.). 1125-1165.

[3] Black, F. and Scholes, M. (1974). The Effects of Dividend Yield and Dividend Policy on Common Stock Prices and Returns. Journal of Financial Economics. 1 (May). 1-22.

[4] Clenddenin, J. and Van Cleave, M. (1954). Growth and Common Stock Values. Journal of Finance. 9 (Dec.). 365-376.

[5] Eades, K., Hess, P. and Kim, E. (1984). On Interpreting Security Returns During the Ex-Dividend Period. Journal of Financial Economics. 13 (March ). 3-34.

[6] Elton, E. and Gruber, M. (1970). Marginal Stockholder Tax Rates and the Clientele Effect. Review of Economics and Statistics. 52 (Feb.) 68-74.

[7] Fama, E. F. and French, K. R. (1988). Dividend Yields and Expected Stock Returns. Journal of Financial Economics. 22 (Oct.). 3-25.

[8] Fama, E. and French, K. (2001). Disappearing Dividends: Changing Firm Characteristics or Lower Propensity to Pay? Journal of Financial Economics. 60 (Apr.). 3-43.

[9] Fama, E. and Miller, M. (1972). The Theory of Finance. Florida: Dryden Press.

[10] Feenberg, D. (1981). Does the Investment Interest Limitation Explain the Existence Of Dividends? Journal of Financial Economics. 9 ( ). 265-269.

[11] Fenn, G.W. and Liang, N. (2001). Corporate Payout Policy and Managerial Stock Incentives. Journal of Financial Economics. 60 (April). 45-72.

[12] Getry, W.M., Kemsly, D. and Mayer, C.J. (2003). Dividend Taxes and Share Prices: Evidence from Real Estate Investment Trusts. Journal of Finance. 58 (Feb.). 261-282.

[13] Gordon, M. (1959). Dividends, Earnings and Stock Prices. Review of Economics and Statistics. 41 (May). 99-105.

[14] Graham, B. and Dodd, D. (1951). Security Analysis. (3rd Ed.). New York: McGraw-Hill.

[15] Grullon, G. and Michaely, R. (2002). Dividends, Share Repurchases, and the Substitution Hypothesis. Journal of Finance. 57 (Aug.). 1649-1684.

[16] Hess, P. (1982). The Ex-Dividend Day Behavior of Stock Returns: Further Evidence On Tax Effects. Journal of Finance. 37 (May). 445-456.

[17] Keown, A., Martin, J., Petty, J. and Scott, D. (2001). Foundations of Finance. (3rd ed.). New Jersey: Prentice Hall.

[18] Koch, A. and Sun, A. (2004). Dividend Changes and the Persistence of Past Earnings Changes. Journal of Finance. 59 (Oct.). 2093-2116.

[19] LaPorta, R. Lopez, F., Shleifer, A. and Vishny, R. (2000). Agency Problems and Dividend Policies Around the World. Journal of Finance. 55 (Feb.). 1-33.

[20] Litzenberger, R.H. and Ramaswamy, K. (1979). The Effect of Personal Taxes and Dividends on Capital Asset Prices. Journal of Financial Economics. 7 (June). 163-195.

[21] Long, J. B. Jr. (1977). Efficient Portfolio Choice with Differential of Dividends and Capital Gains. Journal of Financial Economics. 5 (May). 25-53.

[22] Miller, M. and Modigliani, F. (1961). Dividend Policy, Growth, and the Valuation of Shares. Journal of Business. 34 (Oct.). 411-433.

[23] Miller, M. and Scholes, M. (1978). Dividends and Taxes. Journal of Financial Economics. 6 (Dec.). 333-364.

[24] Miller, M. and Scholes, M. (1982). Dividends and Taxes: Some Empirical Evidence. Journal of Political Economy. 90 (Dec.). 1118-1141.

[25] Naranjo, A., Nimalendran, M., and Ryngaert, M. (2000). Time Variation of Ex-Dividend Day Stock Returns and Corporate Dividend Capture: A Reexamination. Journal of Finance. 55 (Oct.). 2357-2372.

[26] Pilotte, E.A. (2003). Capital Gains, Dividend Yields, and Expected Inflation. Journal of Finance. 58 (Feb.). 447-466.

[27] Pringle, J. and Harris, R. (1984). Essentials of Managerial Finance. Illinois: Scott, Foresman and Company.

[28] Smith, C. and Watts, R. (1992). The Investment Opportunity Set and Corporate Financing, Dividends, and Compensation Policies. Journal of Financial Economics. 32 (Dec.). 263-292.

TRANSFER OF COPYRIGHT

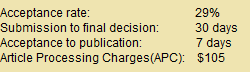

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.