The INFLUENCE OF PROFITABILITY, CASH FLOW, AND STOCK RETURNS ON EQUITY MARKET VALUES BASED ON COMPANY LIFE CYCLE (Study of Manufacturing Companies Listed in Indonesian stock exchange)

Abstract

The purpose of this study is to examine the effect of profitability, cash flow, and stock returns on equity market values based on company life cycle of manufacturing companies listed in Indonesian Stock Exchange over the period of 2012-2014. The data used in this study were obtained from audited financial reports which published by the capital market reference center on the Indonesian Stock Exchange. The type of this research is the hypothesis testing which is applied the purposive sampling method and there are 204 samples of the company as the research object. The results of the study indicate that simultaneous profitability variables, cash flow, and stock returns have a positive effect on equity market values regarding the company's life cycle. While, in the partial test the results of the study point that (1) Profitability at the stage of growth, mature and decline have a positive effect on equity market value. (2) The operating cash flow at the stage of growth, mature and decline have a positive effect on equity market value. (3) Investment cash flow at the stage of growth, mature and decline have a positive effect on equity market value. (4) Financing cash flow at the stage of growth, mature have a positive effect on equity market value while the decline stage has a negative effect on equity market value. (5) The stock returns at the stage of growth and maturity have a positive effect on equity market value while at the decline stage has a negative effect on equity market value.

Downloads

References

terhadap Harga Saham. Skripsi. Fakultas Ekonomi Universitas Diponogoro. Semarang.

Affinanda, Ade. (2015). Analisis Pengaruh Rasio Keuangan Terhadap Return Saham

Perusahaan Dalam Indeks LQ 45. Skripsi. Universitas Diponegoro. Semarang.

Ariani, Nanda. (2012). Pengaruh Laba Dan Arus Kas Terhadap Nilai Pasar

Ekuitas Berdasarkan Siklus Hidup Pada Perusahaan Manufaktur. Skripsi. Fakultas Ekonomi Universitas Syiah Kuala. Banda Aceh.

Anggraeni, V. (2007). Pengaruh Tingkat Disclosure dan Nilai Pasar Ekuitas

terhadap Biaya Ekuitas. Skripsi. Universitas Kristen Petra. Surabaya.

Anthony dan Govindrajan. (2005). Management Control System, Edisi 11,

Penerjemah: F.X. Kurniawan Tjakrawala, Dan Krisna. Penerbit Salemba Empat, Jakarta.

Anthony, J.H,. dan K. Ramesh. (1992). Association Beetwen Accounting

Performance Measure & Stock Prices: A Test of The Life Cycle Hypothesis. Jurnal Of Accounting & Economics. 15:203-227.

Anthony, J.H,. dan N, Yehuda. (2006). Corporate Life Cycle and Value-Relevan Of

Cash Flow versus Accrual Financial Information. Journal Of Accounting And Finance. 3: 1-26.

Atmini, Siti. (2002). Asosiasi siklus hidup perusahaan dengan incremental value -

relevance informasi laba & arus kas. Jurnal riset akuntansi Indonesia. Vol 5, no. 3: 257-276.

Bagus Sutarno. (2002). Analisi Pengaruh Laba Dan Arus Kas Terhadap Siklus

Hidup Perusahaan Diukur Dengan Nilai Pasar Ekuitas. Tesis.Universitas Diponegoro. Semarang.

Baridwan, Zaki. (1997). Analisis Nilai Tambah Informasi Laporan Arus Kas. Jurnal

Ekonomi Dan Bisnis Indonesia. Vol. 12, No. 2: 1-14.

Belkaoui, A.R. (2007). Accounting Theory. Buku 2. Jakarta: Salemba Empat.

Black, E. L. (1998). Life-Cycle Impacts on The Incremental Value-Relevance of

Earnings And Cash Flow Measures. Journal of Financial Statement Analysis 4: 40-50.

Brigham, Eugene F. and Joel F. Houston. (2001). Fundamentals of Financial

Management. Ninth Edition. Horcourt College. United States of America

Chung, K.H. dan Charoenwong C. (1991). Investment Options, Asset In Place, and

The Risk Of Stocks. Financial Management. Autum. 20: 21-33.

Gujarati, D.N. (2013). Basic Economics. New York : Mc Grow – Hill Company.

Habbe, A.H dan J Hartono. (2001). Study Terhadap Pengukuran Kinerja Akuntansi

Perusahaan Orospektor Dan Defender Dan Hubungannya Dengan Harga Saham; Analisis Dengan Pendekatan Life-Cycle Theory. Jurnal riset akuntansi Indonesia 4.1:111-132.

Hartono, Jogiyanto, (2009), Teori Fortofolio dan Analisis I nvestasi , Edisi

Keenam. BPFE, Yokyakarta.

Helfert, Erick A, (2000). Teknik Analisis Keuangan: Petunjuk Praktis Untuk

Mengelola dan Mengukur Kinerja Perusahaan. Dialihbahasakan Oleh Herman Wibowo, Edisi Kedelapan , Erlangga, Jakarta.

Horngren dan Sundem. (2000). Pengantar Akuntansi Keuangan 2. Jakarta:

Erlangga.

http:www.idx.co.id.

Idawati, Ida Ayu Agung dan Gede Merta Sudiartha. (2013). Pengaruh

Profitabilitas, Ukuran Perusahaan Terhadap Kebijakan Dividen Perusahaan Manufaktur Di BEI. Jurnal Manajemen Universitas Udayana. Vol. 3. No. 6:1604-1619.

Jusuf, Hariyanto. (2002). Efisiensi Pasar Modal di Bursa Efek Jakarta. Jurnal

Ekonomi STEI. No. 1/Th.X1/19/Januari-Maret 2002.

Lestari, S., & Paryanti, AB. (2016). Pengaruh Profitabilitas Dan Kebijakan Deviden

Terhadap Nilai Perusahaan Pada Perusahaan Perbankan Yang Terdaftar Di BEI Tahun 2006-2010. Jurnal CKI On SPOT, 9, 53-62.

Martono & Harjito. (2012). Manajemen Keuangan. Edisi Ke-2. Ekonisia. Yokyakarta.

Pasaribu, M.Y., Topowijoyo., & Sulaswati, S. (2006). Pengaruh Struktur Modal, Struktur

Kepemilikan, dan Profitabilitas Terhadap Nilai Perusahaan pada Perusahaan Sektor Industri Dasar dan Kimia Yang Terdaftar di BEI tahun 2011-2014. Jurnal Administrasi Bisnis, 35, 154-164.

Rachmawati, Andri dan Hanung Triatmoko, (2007), Analisis Faktor-faktor yang

mempengaruhi Kualitas Laba dan Nilai Perusahaan, Skripsi Fakultas Ekonomi, Universitas Sebelas Maret, Surakarta.

Reilly, K Frank dan Edgar A. Norton. (2003). Investment. Sixth Edition. Thomsom

Learning. Canada.

Rizqia, D.A., Aisyah, S., & Sumiati (2013). Effect of Managerial Ownership, Financial

Leverage, Profitability, Firm Size, and Investment Opportunity on Dividend Policy and Firm Value. Jurnal of Finance and Accounting, 4, 120-130.

Sartono, Agus. (2001). Manajemen Keuangan Teori Dan Aplikasi. Edisi

4.Yokyakarta:BPFE.

Sabrina, N. T. (2008). Pengaruh Luas Pengungkapan Sukarela dan Informasi

Asimetri terhadap Cost of Equity Capital (Studi pada Perusahaan Perusahaan on Firm (Evidence From Pakistan). International Conference on E-business, Management and Economics, 3, 22-26.

Shah, S.Z.A., Ullah, W., & Hasnain, B. (2010). Impac of Ownership Structure on Dividend

Policy

Sandy dan Asyik, Ahmad Dan Nur Fadjrih Asyik. (2013). Pengaruh Ptofitabilitas

dan Likuiditas Terhadap Kebijakn Devide Kas Pada Perusahaan Otomomotif, Jurnal Ilmu dan Akuntansi, Vol. 1 No, 1 No.1:58-76.

Santoso, Imam. (2009). Pengaruh Profitabilitas Terhadap Manajemen Laba Pada

Perusahaan Perbankan Yang Terdaftar Di Bursa Efek Indonesia.

Sekaran, Uma. (2006). Metodologi Penelitian Untuk Bisnis: Edisi Keempat. Alih

Bahasa: Kwan Men You. Jakarta: Salemba Empat.

Setiyadi, Aman. (2017). Pengaruh Rasio Keuangan Terhadap Investement

Opportunity Set Pada Tahap Penurunan. Skipsi. Fakultas Ekonomi dan Bisnis.Universitas Muhammadiyah Purwokerto.

Sri Hermuningsih. (2013) Bulletin Ekonomi Moneter dan Perbankan. Lecturer at

Economic Department. University of Sarjanawiyata Taman siswa

Yogyakarta: hermun_feust@yahoo.co.id.

Suharli, Michell. (2006). Studi Empiris Mengenai Pengaruh Profitabilitas,

Leverage, dan Harga Saham Terhadap Jumlah Dividen Tunai (Studi Pada Perusahaan Yang Terdaftar Di Bursa Efek Jakarta Periode 2002-2003). Jurnal MAKSI. Vol. 6 No.2:243-245.

Susanti, Eva Islahuddin, dan Muhammad Arfan. (2012). Pengaruh Profitabilitas,

Finansial Leverage Dan Acid Test Ratio Terhadap Dividen Tunai Pada Perusahaan Industry Dasar Dan Kimia Yang Terdaftar Di Bursa Efek Indonesia Periode 2008-2010. Jurnal Akuntansi Pascasarjana Universitas Syiah Kuala. Vol. 2, No.1.\

Wijaya, E. (2015). Pengaruh Struktur Kepemilikan, Kebijakan Deviden, Kebijakan

Pendanaan, dan Profitabilitas Terhadap Nilai Perusahaan. Jurnal Ilmiah Manajemen, 3, 1-14.

Wild, John J dkk. (2005). Financial Statement Analysis. Jakarta : Salemba Empat.

TRANSFER OF COPYRIGHT

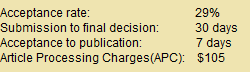

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.