The Influence Factors of Firm Value (Study of Manufacturing Company Listed on Indonesia Stock Exchange)

Abstract

This study tries to empirically examine the effect of profitability, institutional ownership, managerial ownership, and dividend policy on company value in manufacturing companies listed on Indonesian Stock Exchange. The data used in this research is a financial statement of the companies with the total sample of 93 companies over the period of 2012-2016. The analytical method used in this study is multiple linear regression. This study resulted in that profitability, institutional ownership, managerial ownership, and dividend policy simultaneously influence the value of the company. While from the partial test it resulted that profitability affects the company value, institutional ownership has no influence on the company value. However, managerial ownership has no influence on the company value and dividend policy also does not affect the company value.

Downloads

References

Ali, H., & Miftahurrohman. (2014). Pengaruh Struktur Kepemilikan Saham, Kebijakan Dividen, dan Kebijakan Hutang Terhadap Nilai Perusahaan (Studi Pada Perusahaan Yang Terdaftar di BEI). Jurnal Etikonomi, 13, 148-163.

Apriada, K., & Suardikha, M.S. (2016). Pengaruh Struktur Kepemilikan Saham, Struktur Modal, dan Profitabilitas Pada Nilai Perusahaan. E-Jurnal Ekonomi dan Bisnis Unud, 2, 201-218.

Ariasih, N.W.Y., & Sunarsih, N.I. (2017). Pengaruh Profitabilitas Struktur Kepemilikan dan Struktur Modal Terhadap Kebijakan Inisiasi Dividen Pada Perusahaan Initial Public Offering Yang Terdaftar Di BURSA EFEK INDONESIA. Jurnal Riset Akuntansi, 7, 40-53.

Dewi, A.A.A.K., & Badjra, I.B. (2017). Pengaruh Profitabilitas, Aktiva Tidak Berwujud, Ukuran Perusahaan, dan Struktur Modal Terhadap Nilai Perusahaan. E-Jurnal Manajemen Unud, 6, 2161-2190.

Eisenhardt, K. M. (1989). Agency Theory: An Assessment and Review. The Academy of Management Review. 4, 57-74.

Gordon, M.J. (1959). The dividend, Earning and Stock Prices, The Review of Economics and Statistics, 41, 99-105.

Jensen, M. & Meckling, W. (1976). Theory of The Firm: Managerial Behavior, Agency Cost and Ownership Structure. Journal of Financial Economics, 3, 305-360.

TRANSFER OF COPYRIGHT

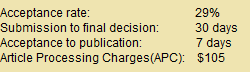

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.