A Model for Pricing Insurance Using Options

Abstract

Traditional Expected Value and Bayesian Methods of pricing insurance products are not robust both under minimal data and frequent portfolio adjustments. Deriving a partial di_erential equation for the price of a an insurance put, parallel is struck with the reverse Black Scholes partial di_erential equation for pricing call options. With appropriate parameter translation of the Black Scholes model, a Pure Premium valuation function that is an improvement over the traditional methods of pricing insurance products results. Its robustness is illustrated with the pricing of a third party insurance product for private cars.

Downloads

References

Wolfgang Buchholz and Michael Schymura. Expected utility theory and the tyranny of catastrophic risks.

Ecological Economics, 77:234{239, 2012.

Hans Buhlmann. The general economic premium principle. Astin Bulletin, 14(01):13{21, 1984.

Stephen P D'arcy. On becoming an actuary of the third kind. 1989.

Stephen P D'Arcy and James R Garven. Property-liability insurance pricing models: an empirical

evaluation. Journal of Risk and Insurance, pages 391{430, 1990.

Neil A Doherty and James R Garven. Price regulation in property-liability insurance: A contingent-claims approach. The Journal of Finance, 41(5):1031{1050, 1986.

Paul Embrechts. Actuarial versus _nancial pricing of insurance. The Journal of Risk Finance, 1(4):17/26,2000.

Jon Holtan. Pragmatic insurance option pricing. Scandinavian Actuarial Journal, 2007(1):53{70, 2007.

Ravi Jagannathan and Zhenyu Wang. The conditional capm and the cross-section of expected returns.

The Journal of _nance, 51(1):3{53, 1996.

Edi Karni. Savages^a subjective expected utility model. 2005.

Roger JA Laeven and Marc J Goovaerts. Premium calculation and insurance pricing. Encyclopedia of Quantitative Risk Analysis and Assessment.

Chris K Madsen, GE Insurance Solutions, Svend Haastrup, and Hal W Pedersen. A further examination of insurance pricing and underwriting cycles. 2005.

Robert C Merton. Theory of rational option pricing. The Bell Journal of economics and management science, pages 141{183, 1973.

Robert A Pollak. Additive von neumann-morgenstern utility functions. Econometrica, Journal of the Econometric Society, pages 485{494, 1967.

John Quiggin. A theory of anticipated utility. Journal of Economic Behavior & Organization, 3(4):323{343, 1982.

Neeza Thandi Sholom Feldblum. Financial pricing models for property-casualty insurance products investment yields. The Bell Journal of economics and management science, pages 141{183, 2002.

David Skurnick. Survey of loss reserving methods.

Son Van Lai and Michel Gendron. On _nancial guarantee insurance under stochastic interest rates. The GENEVA Papers on Risk and Insurance-Theory, 19(2):119{137, 1994.

Shaun S Wang. A universal framework for pricing _nancial and insurance risks. Astin Bulletin, 32(02): 213{234, 2002.

Shaun S Wang. Equilibrium pricing transforms: new results using buhlmann^as 1980 economic model.

Astin Bulletin, 33(01):57{73, 2003.

Shaun S Wang, Virginia R Young, and Harry H Panjer. Axiomatic characterization of insurance prices.Insurance: Mathematics and economics, 21(2):173{183, 1997.

Geo_ Werner and Claudine Modlin. Basic ratemaking.

Menahem E Yaari. The dual theory of choice under risk. Econometrica: Journal of the Econometric Society, pages 95{115, 1987.

TRANSFER OF COPYRIGHT

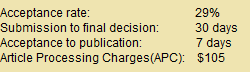

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.