Agency Cost and Court Action in Bankruptcy Proceedings in a Simple Real Option Model

Abstract

While legally considered the residual interest, equity holders are often given a very small share of the liquidation value of a bankrupt corporation, even when liquidation value does not cover all other claims with higher priority. Such expected residual value for equity holders can lead to changed corporate investment incentive which counteracts the well-documented sub-optimal operation for a firm in financial distress. This paper constructs a model illustrating the agency problem in sub-optimal investment of a firm in financial distress and how court action in compensating equity restores the proper incentive. Such court action that violates the priority rule is ex ante rational and result in higher social benefit, even though it seems expost unfair.

Downloads

References

Amram, M. and N. Kulatilaka, Real Options: Managing Strategic Investment in an Uncertain World. Harvard Business School Press, 1999.

Baldwin, C., “Competing for Capital in a Global Environment”, Midland Corporate Finance Journal, Spring 1987, pp. 4364.

Bjerksund, P., and Ekern, S., “Managing Investment opportunities under Price Uncertainty: from ‘Last Chance’ to ‘Wait and See’ Strategies,” Financial Management, Autumn 1990, pp. 6583.

Black, F., and Scholes, M., “The Pricing of Options and Corporate Liabilities,” Journal of Political Economy, May/Jun 1973, pp. 637659.

Brennan, M., and Schwartz, E., “Evaluating Natural Resource Investments,” Journal of Business, April 1985, pp.135157.

Copeland, T., and Weston, J. F., “A Note on the Evaluation of Cancellable Operating Leases,” Financial Management, Summer 1982, pp. 6067.

Cox, j., Ross, S., and Rubinstein, M., “Option Pricing: A Simplified Approach,” Journal of Financial Economics, September 1979, pp. 229263.

Kemna, A. “Case Studies on Real Options,” Financial Management, Autumn 1993, pp. 259270.

Kogut, B., and Kulatilaka, N., “Operating Flexibility, Global Manufacturing, and the Option Value of a Multinational Network,” Management Science, 1993.

Kolbe, A. L., Morris, P. A., and Treisburg, E. O., “When Choosing R&D Projects, Go with Long Shots,” ResearchTechnology Management, Jan/Feb 1991.

Kulatilaka, N., “Valuing the Flexibility of Flexible Manufacturing Systems”, IEEE Transactions in Engineering Management, 1988, pp. 250257.

Kulatilaka, N., and Trigeorgis, L., “The General Flexibility to Switch: Real Options Revisited,” International journal of Finance, December 1993.

Mason, S. P., and Baldwin, C., “Evaluation of Government Subsidies to Largescale Energy Projects: A Contingent Claims Approach,” Advances in Futures and Options Research, 1988, pp. 169181.

McConnell, J., and Schallheim, J., “Valuation of Asset Leasing Contracts,” Journal of Financial Economics, August 1983, pp. 237261.

Myers, S., “Determinants of Corporate Borrowing,” Journal of Financial Economics, 1977, 5 (2), pp. 147-175 .

Narayanaswamy, C.R. and Schirm, David and Shukla, Ravi, “Stockholder-Bondholder Conflict: Application of Binomial Option Pricing Methodology,” Journal of Applied Finance, 2001, 11, pp. 35-40.

Smith, K. W., and Triantis, A., “The Value of Options in Strategic Acquisitions,” in Real Options in Capital Investment: New Contributions, L. Trigeorgis (ed.), 1993, Praeger, New York.

Treisburg, E., “An Option Valuation Analysis of Investment Choices by a Regulated Firm,” Management Science, 1993.

Trigeorgis, L., “Real Options and Interactions with Financial Flexibility,” Financial Management, Autumn 1993, pp. 202224.

Trigeorgis, L., Real Options. The MIT Press, 1996.

Varian, H., “The Arbitrage Principle in Financial Economics,” Journal of Economic Perspectives, Winter 1987.

TRANSFER OF COPYRIGHT

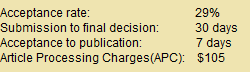

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.