The EFFECT OF FINANCIAL PERFORMANCE, EXTERNAL FACTORS, AND OPERATIONAL RATIO ON CAR RATIO OF SHARIA COMMERCIAL BANKS IN INDONESIA

Case Study : COMMERCIAL SHARIA BANKS IN INDONESIA

Abstract

Capital becomes an important part of a bank, even to determine the bank is healthy or not is assessed from its capital ratio. Likewise, sharia banks in Indonesia are growing rapidly in this modern era. The maximum use of capital in profit-sharing financing is believed to be more a leverage than investments such as sukuk and others. The growth of sharia banking in Indonesia is considered slow when compared to growth in foreign countries, while Indonesia as the largest Muslim population in the world has greater potential than other countries. The monetary climate and the lack of capital that enter sharia banks are believed to be the cause of the slow growth of sharia banking in Indonesia. In this study I found that ROE of 0.1% and Inflation of 0.466% had a positive effect on the CAR ratio, while GDP was 0.431% and BOPO was 0.116% with negative effect on the CAR ratio.

Downloads

References

[2] Azwir, Yacub. 2006. “ANALISIS PENGARUH KECUKUPAN MODAL, EFISIENSI, LIKUIDITAS, NPL, DAN PPAP TERHADAP ROA BANK”.Tesis Program Studi Magister Manajemen Program Pascasarjana Universitas Diponegoro, dipublikasikan.

[3] Hasan, M. A. (2003). Berbagai Macam Transaksi dalam Islam (Fiqh Muamalat). Jakarta: PT Raja Grafindo Persada.

[4] Islam, M. Muzahidul and Hasibul Alam Chowdhury (2007).“ A Comparative Study of Liquidity Management of an Islamic Bank and a Conventional Bank: The Evidence from Bangladesh”.Department of Banking, University of Dhaka

[5] Kajian Stabilitas Keuangan ( No. 16, Maret 2011)

[6] Kuncoro dan Suhardjono, 2002, Manajemen Perbankan (Teori dan Aplikasi), Edisi Pertama, Penerbit BPFE , Yogyakarta

[7] Nandadipa, Seandy. 2010. “ANALISIS PENGARUH CAR, NPL, INFLASI, PERTUMBUHAN DPK, DAN EXCHANGE RATE TERHADAP LDR ”. Skripsi Fakultas Ekonomi Universitas Diponegoro.

[8] Statistik Perbankan Syariah 2014

[9] Surat Edaran Bank Indonesia No.6/23/DPNP 31 Mei 2004. Jakarta: BI, 2004.

TRANSFER OF COPYRIGHT

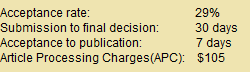

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.