Investor Behavior and Company Values

Abstract

The company's goal is to maximize shareholder wealth through increased value of the company. The value of the company is the market value of debt and equity securities outstanding companies and the investors' perception of the level of success of the company. In investing, investors were not only using the estimate of the prospects of investment instruments, but psychological factors are already in determining the investment. This paper attempts to examine the behavior of investors linked to the company and presenting it to us that investors in the decision to consider psychological factors.

Downloads

References

[2] Brealey, Richard.A., Stewart C, Myers. Alan J, Marcus. 2001. Fundamentals of Corporate finance. Third edition, Singapore: MC-Graw - hill.

[3] Brigham F. Eugene and Joel F. Houston. 1998. Fundamentals of Financial Management. Eighth Edition, New York: The Dryden Press, Harcourt Brace College Publishers.

[4] Brigham, E.F and Gapenski, L.C.1996, Intermmediate finance management 5th ed.). Harbor Drive: the Dryden Press.

[5] Brigham, Eugene F., and Houston Joel F, 2001, Fundamentals of Financial Management, Eight edition, the Dryden Press, Orlando.

[6] Damodaran, Aswath, 2001, Corporate Finance Theory and Practice, Second Edition, John Wiley & Sons Inc, New York.

[7] Damodaran, Aswath, 2006, Damodaran on Valuation, John Wiley and Sains Inc, Swiss Easterbrook, F.H. 1984, "Two agency - cost explanations of dividends", American Economic Review, vol. 74, no. 2, pp. 650-659.

[8] Eugene F. Fama, 1978, the Effect of the firm's investment and financing decision on the welfare of its security holders, the American economic review, vol. 68.no.3. June, p. 272-284.

[9] Forum for Corporate Governance in Indonesia, the role of the Board of Commissioners and the Audit Committee on the Implementation of Corporate Governance (GCG)

[10] Gaver, Jennnifer J., dan Kenneth M. Gaver (1993), “Additional Evidence on the Association between the investment Opportunity Set and Corporate Financing, Dividend, and Compensation Policies”. Journal of Accounting and Economics, Vol. 16: pp. 125-160.

[11] Goldberg, Joachim and Rudiger Von Nitzsch (2001); Behavioral Finance; John Wiley & Sons Gordon, Gary and Matthias Kahl, 1989, the Scarcity of Effective Monitors and Its Implication of Corporate Takeovers and Ownership Structure, Working Paper, July 7, Pp. 1-39.

[12] Gul, Ferdinand. A. 1999. Government Share Ownership, Investment Opportunity Set and corporate policy choices in China. Pacific-Basin Finance Journal No. 7, 157-172.

[13] Jensen. C. Michael, And William H. Meckling, 1976, the Theory of firm : Managerial Behavior, Agency Cost, and Ownership Structure, Journal of Financial Economics, 3, July, p.305-310.

[14] Jensen, M. (1986). "Agency cost of free cash flow, corporate finance, and take-over: corporate finance, and takeovers. American Economic Review 76 (2), pp.360.

[15] Jogiyanto, 2003, Teori Portofolio dan Analisis Investasi, BPFE: Yogyakarta.

[16] Jones, Steward and Sharma. R, 2001. The Association between the Investment Opportunity Set and Corporate Financing and Dividend Decisions: Some Australian Evidence.

[17] Managerial Finance, vol. 27 No. 3, 48-64 Michael C. Jensen, 1986 Agency Cost Of Free Cash Flow, Corporate Finance and Takeovers, American economic review, May, Vol. 76, No. 2p. 323-329.

[18] William H. Meckling, 1976, Theory Of Firm: Managerial Behavior, Agency Cost, and Ownership Structure, Journal of Financial Economics, 3, July, p.305-360.

[19] Keown, Arthur. J., Martin., 2004, "Financial Management: Principles and Application", Pearson Prentice Hall Mangantar. M, 2017, Value of the Company: A Review of Literature, Journal of Research in Business, Economics and Management, vol. 8 No.1, pp.1249-1257.

[20] Mangantar, M., and Muhammad Ali, 2015, an Analysis of the Influence of Ownership Structure, Investment, Liquidity and Risk to Firm Value: Evidence From Indonesia, American Journal of Economics and Business Administration, Vol. 7 No.4, November, P. 166-176 DOI: 10.3844 / ajebasp.2015.166.176.

[21] Manurung. A.H, 2012, the Investment Theory: Concepts and Empirical; Adler Manurung NV Press Monks, Robert A.G and Minow, N. Corporate Governance 3rdedition. 2003 Blackwell Publishing.

[22] Natapura. C, 2009, Institutional Investor Behavior Analysis with Analytical Approach Hierarchy Process (AHP), Business & Bureaucracy, Journal of Administrative Sciences And Organization, pp. 180-187, ISSN 0854-3844, Volume 16, Number 3.

[23] Septyanto,D. 2013, Factors Affecting Individual Investors in Securities Investment Decision Making in the Indonesia Stock Exchange (BEI), Jurnal Ekonomi, Vo; 4 No.2.

[24] Smart, Scott B., William L. Megginson And Lawrence J. Gitman, 2004, Corporate Finance,Thomson, South Western. USA.

TRANSFER OF COPYRIGHT

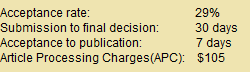

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.